The Ultimate Guide to Expanding Your Investment Portfolio Efficiently

The Ultimate Guide to Expanding Your Investment Portfolio Efficiently

Blog Article

Maximize Your Returns With Diversified Financial Investment Portfolios

In today's intricate financial landscape, optimizing returns via varied investment portfolios is not simply helpful yet necessary. A well-structured profile can effectively balance risk and benefit by dispersing investments across different possession classes and geographies. Recognizing the subtleties of diversification, including which asset classes to focus on and just how to readjust your strategy over time, is crucial for long-term success. As we explore these elements, it comes to be noticeable that the course to improved returns is laden with both chances and potential mistakes. What techniques can be used to browse this detailed surface?

Comprehending Diversification

By including a variety of investments, a capitalist can potentially improve returns while decreasing the influence of volatility. While equities may experience considerable changes, fixed-income safeties commonly supply security. Geographic diversification can secure an investor from localized financial declines, as different areas may expand or get individually.

Effective diversification entails mindful choice and allotment of assets to ensure a balanced direct exposure to run the risk of. An over-concentration in a single sector or possession class can negate the benefits of diversity, increasing vulnerability to market changes.

Inevitably, recognizing diversification is essential for investors looking for to build resilient profiles. It motivates a long-lasting perspective, emphasizing the importance of readjusting allocations in action to transforming market problems, investment goals, and risk tolerance. This critical strategy cultivates a more secure investment environment, helpful to attaining economic purposes.

Secret Asset Classes to Think About

Equities, or stocks, provide the potential for capital appreciation and are critical for long-term growth. They can be further divided into large-cap, mid-cap, and small-cap stocks, each offering differing levels of risk and return.

Fixed earnings investments, such as bonds, use stability and revenue with passion settlements. They act as a barrier versus market volatility, helping to maintain resources while offering foreseeable returns.

Realty financial investments, whether with straight residential property possession or realty investment depends on (REITs), can supply diversification and possible inflation defense - Investment. They normally exhibit reduced relationship with conventional supply and bond markets

Last but not least, cash or money matchings, such as cash market funds, offer liquidity and security, making certain that financiers can access funds when required. By including these vital possession classes, financiers can create a balanced profile that lines up with their risk resistance and monetary objectives.

Strategies for Developing a Profile

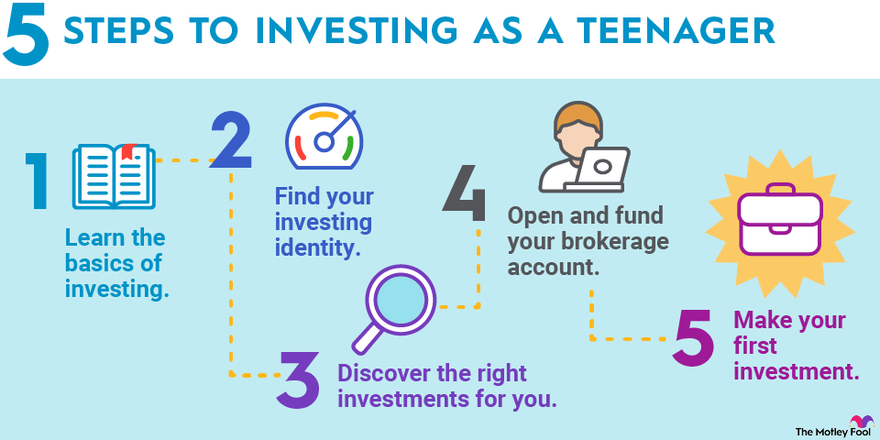

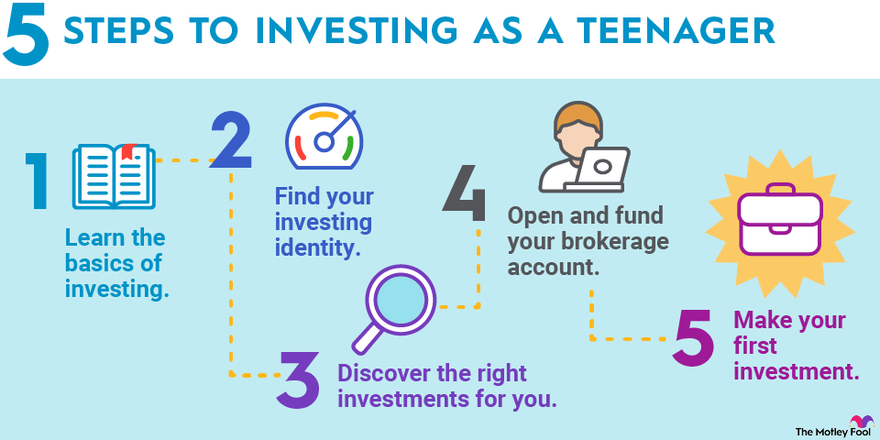

5 essential strategies can lead investors in building a durable profile tailored to their distinct economic goals and run the risk of tolerance. Define clear investment purposes. Establish whether the focus gets on capital development, revenue generation, or a combination of both, as this will certainly inform property allotment.

2nd, diversify across property classes. A mix of equities, set income, property, and different investments can lower risk and improve returns. Go for a balance that lines up with your threat profile.

Third, take into consideration geographic diversification (Investment). Purchasing global markets can provide exposure to development opportunities while reducing residential financial variations

Fourth, frequently testimonial and readjust your risk tolerance. As life circumstances alter, so also needs to your portfolio. It's essential to make sure that your financial investments remain lined up with your monetary circumstance and purposes.

Last but not least, make use of tax-advantaged accounts. Using pension or tax-efficient financial investment lorries can boost total returns by lessening tax obligation obligations. By visit the website applying these approaches, investors can create a well-structured profile that not only satisfies their economic goals however additionally withstands market volatility.

Monitoring and Rebalancing Investments

Rebalancing entails adjusting the weights of different properties within the portfolio to restore the initial or desired allowance. This procedure not only manages danger yet also permits capitalists to maximize market motions by marketing overperforming assets and getting underperforming ones, thus sticking to a self-displined financial investment method.

Investors ought to establish a routine tracking routine, such as quarterly or semi-annually, to assess their portfolios. This frequency allows for timely adjustments while minimizing the effect of temporary market volatility. In addition, substantial life occasions or adjustments in economic objectives may require a much more prompt rebalancing.

Ultimately, constant surveillance and rebalancing equip capitalists to keep control over their profiles, guaranteeing they continue to be lined up with their long-term objectives and risk tolerance, thereby taking full advantage of prospective returns in a varied financial investment landscape.

Usual Errors to Prevent

Capitalists typically encounter a number of usual mistakes that can impede the success of their varied financial investment portfolios. One widespread error is stopping working to perform extensive study before making investment choices.

Another typical mistake is ignoring to routinely rebalance the profile and review. Market fluctuations can modify the initial asset allotment, and stopping working to readjust can undermine diversity advantages. Psychological decision-making additionally positions substantial dangers; investors might react impulsively to market volatility, causing early sales or missed out on opportunities.

Furthermore, focusing as well greatly on previous efficiency can be deceptive. Since a possession has actually done well traditionally does not guarantee future success, simply. Undervaluing costs and charges can erode returns over time. Being aware of purchase prices, administration charges, and taxes is vital for preserving a healthy portfolio. By staying clear of these usual risks, investors can enhance the effectiveness of their varied investment strategies and job in the direction of attaining their monetary goals.

Final Thought

In conclusion, the execution of a varied financial investment portfolio acts as a crucial technique for managing threat and boosting returns. By alloting possessions recommended you read throughout numerous classes and locations, investors can minimize potential losses while maximizing diverse market possibilities. Regular tracking and rebalancing further guarantee placement with economic objectives, consequently advertising stability and durability. Inevitably, adopting a varied technique not just targets funding appreciation however likewise fortifies the investment framework against original site market volatility.

A well-structured profile can properly stabilize danger and incentive by dispersing financial investments throughout numerous property courses and geographies.Routinely keeping an eye on and rebalancing financial investments is critical for keeping a profile's placement with a capitalist's objectives and take the chance of resistance. Over time, market variations can create a financial investment profile to wander from its desired property allowance, leading to unintentional direct exposure to take the chance of or missed out on possibilities for development.Financiers often come across a number of typical mistakes that can hinder the success of their varied financial investment profiles.In verdict, the application of a diversified investment profile offers as a vital method for handling risk and enhancing returns.

Report this page